Tuition, housing, food, gas, clothes, coffee: money is a driving factor in many students’ lives and often causes a lot of anxiety on a daily basis. However, it’s unclear what methods students are using to pay for the essential and non-essential items. The choice between using a debit and a credit card is most likely on the minds of students in college because of the pressure to build credit, but how many students actually use a credit card on a regular basis?

Debit is not that much different than using cash; the one step process only requires a debit card and bank account, and involves directly withdrawing money from either a checking or savings account. Al- ternatively, credit involves getting credit and paying it back separately; a certain amount of credit is given that you can pay up to.

Mari Livingston, the Associative Director of financial aid in the Warrior Hub on campus, discussed that students most likely use debit more than credit because of the potential troubles that come with having a credit card.

“When it comes to credit, you have to be very careful,” Living- ston said. “And sometimes, when you are in your late teens, early 20s, it’s easy to get in trouble with it; it’s easy to get it out of hand.”

College students don’t have a lot of experience working with money; however, with the age to get a credit card being 18, it’s possible to start building up credit right out of high school. Livingston stated that the most common issue with college students is most likely the differentiation between wants and needs when it comes to making financial decisions. Making sure you can pay off a credit card payment in a timely manner is important when using a credit card, which is something college students may have troubles with in the beginning.

Regan Hathaway, a third year studying radiography, has owned a credit card since high school because of the influence of her parents. Hathaway said that the main things she uses to buy on her credit card are gas, groceries and her spotify premium subscription; this is to make sure that those payments are always able to be paid off on time.

“[My dad] influenced me a lot to buy a credit card,” Hathaway said. “He always told me that the better your credit score is, then the better your future is set up.”

Livingston echoed this sentiment with her advice about talking to parents, guardians or role models about financial decisions. Learn- ing how to build credit and spend money responsibly is incredibly important for college students as they build credit and begin to pay off student loans. Other than trusted adults, students can also use online resources to increase their intelligence regarding money and money spending.

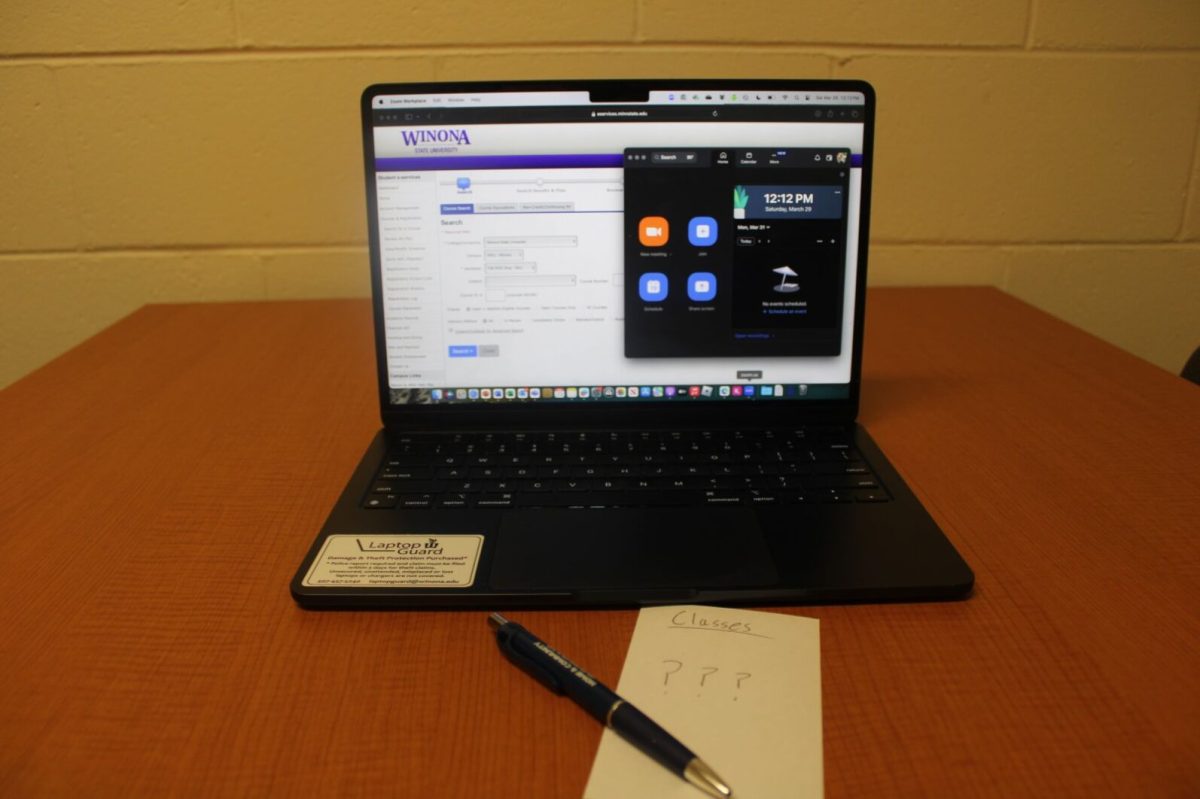

The “Money Management” page on the Winona State University website is a great resource for students who are looking for more information about monitoring credit history, student loan repayment, career choices, resources and more. Resources on campus such as the warrior cupboard are a great place to start if financial struggles are a concern.

Learning about smart financial choices is important as students make their way to their post-grad experiences. However, money is a personal endeavor for everyone, so each person’s financial choices are going to be different from one another.

“Everybody has their own sort of value system when it comes around to it,” Livingston said. “The biggest thing is making those payments on time and just showing that you can be responsible with money will help build their credit report or their credit score.”