Kalika Valentine-Erikson/Winonan

Forget ghost stories and alien sightings—when it comes to most college students, the job market and student loan repayments are scarier than anything that goes bump in the night.

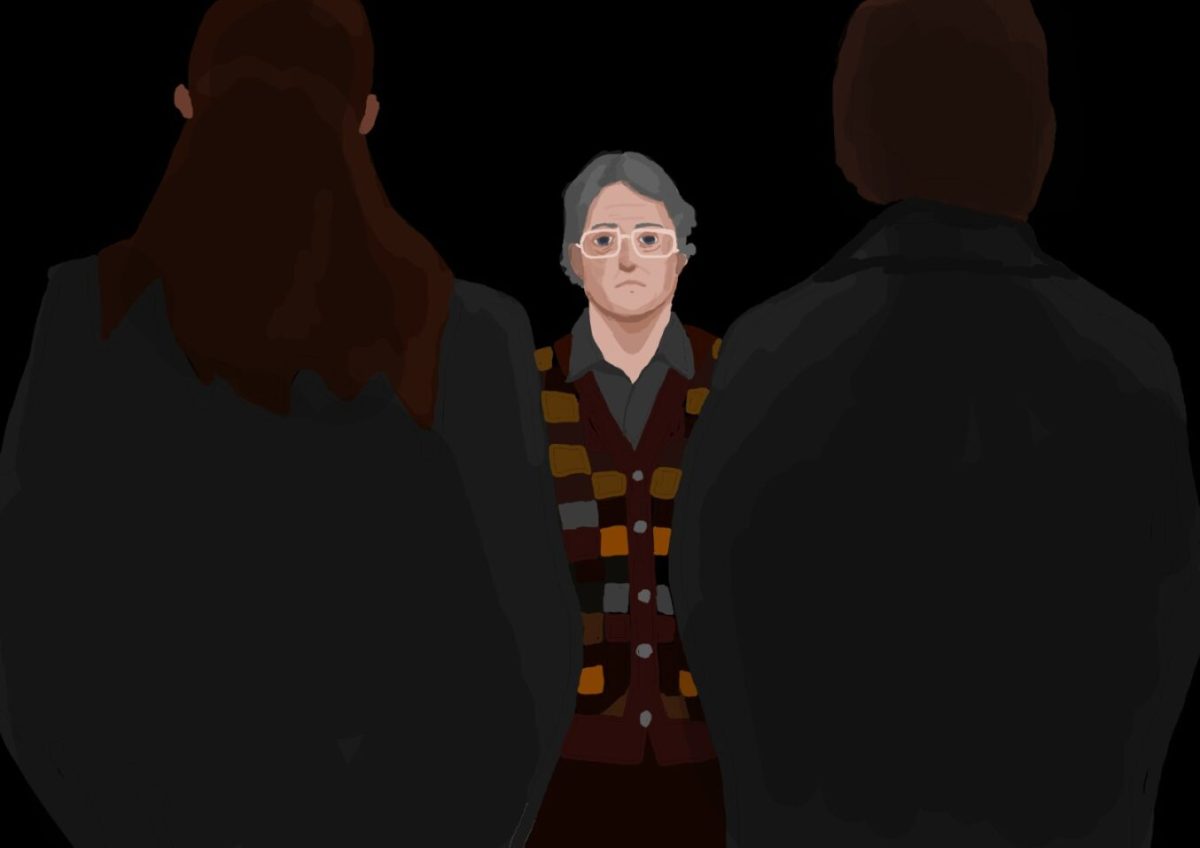

On Wednesday, Nov. 4, CBS News senior business analyst Jill Schlesinger presented “Taking Control of Your Financial Life” as part of the Lyceum Series.

The auditorium was filled with people both young and old, and some people even sat on the floor.

Schlesinger opened with a few jokes about our Minnesota pizza, as she is from New York and said it is “just not the same,” before she got into the true heart of the talk: money.

“Money is a really weird topic. It’s really emotional,” she said. “Investing personal finances, anything with a dollar sign around it, it’s half science and it’s half art.”

Schlesinger said the science is the numbers and the art is of human emotions.

The point of the talk was to help people get the emotions out of money and strictly adhere to the science, or the numbers.

Schlesinger said the first thing one must do when taking control of his or her personal finances is to set goals. She said these goals must be specific, measurable, attainable, relevant and time-bound, which created the acronym SMART.

She discussed the job market and how jobs have been created since the recession that ended in June 2009.

“You’re really lucky that you didn’t graduate five or six years ago,” she said. “Good timing for you guys. You’ll be coming out as the job market is turning around.”

She also told students going to college is definitely worthwhile, because it makes getting a job easier.

Schlesinger shared statistical data which showed there is a 7.9 percent unemployment rate for people with a high school degree, while there is only a 2.5 percent unemployment rate for people with a college degree.

While students are graduating at a time when the unemployment rate is down, managing finances is more difficult than it was for the previous generations.

“The world used to be a much less complicated place for people managing their money,” Schlesinger said.

She did, however, give tips on how to use modern technology in order to manage money effectively.

“[An app] is the easiest thing to use to track your money right now,” she said.

Schlesinger suggested students add up every single penny of money that is spent, including dinner out with friends, every Starbucks drinks, and every Friday night out.

“You have no idea how much you’re spending,” she said.

Schlesinger said people typically do not account for around 10 percent of their income. She said if somebody makes $50,000 a year, he or she will not know where roughly $5,000 of that goes.

She said it is important to know where your money is going and that you are happy with it. If you are shocked you spent $100 at Taco Bell last month, then you need to do something to change that.

Schlesinger’s final advice to students was to first pay down consumer debt, or credit cards, then establish at least six to 12 months of emergency money, and then maximize retirement contributions.

“Retirement seems like a long time away, but I promise if you get in the habit of saving for retirement today, it’s a lot easier to maintain the habit,” she said.

Senior Andrew LaScotte attended the talk for a class.

“The biggest thing I got out of the talk is that you need to have a goal in mind in order to move forward in life, and that understanding finances is less intimidating once you get the facts,” he said.

Senior Hannah Baker attended the talk with LaScotte.

“I learned that it’s important to know what you buy because it will help you in the long run,” she said.

Schlesinger encourages students to start taking control of their financial life now.

“You must fight these emotional urges that lead us astray. You have to stick to your game plan. Take control of your financial life,” she said.