Winona State Reacts to Biden’s Student Debt Relief Plan

On September 3rd, the Biden Administration announced that the Department of Education would be cancelling $10,000 in student loan debt for borrowers earning $125,000 or less per year. An additional $10,000 would be forgiven for Pell Grant recipients.

September 7, 2022

On August 24, President Biden announced his student debt forgiveness plan. This plan seeks to immediately help borrowers who need it most by canceling $10,000 in federal loans through the Department of Education with an additional $10,000 forgiven for Pell Grant recipients. This historic announcement has many students at Winona State University thankful and excited for the future.

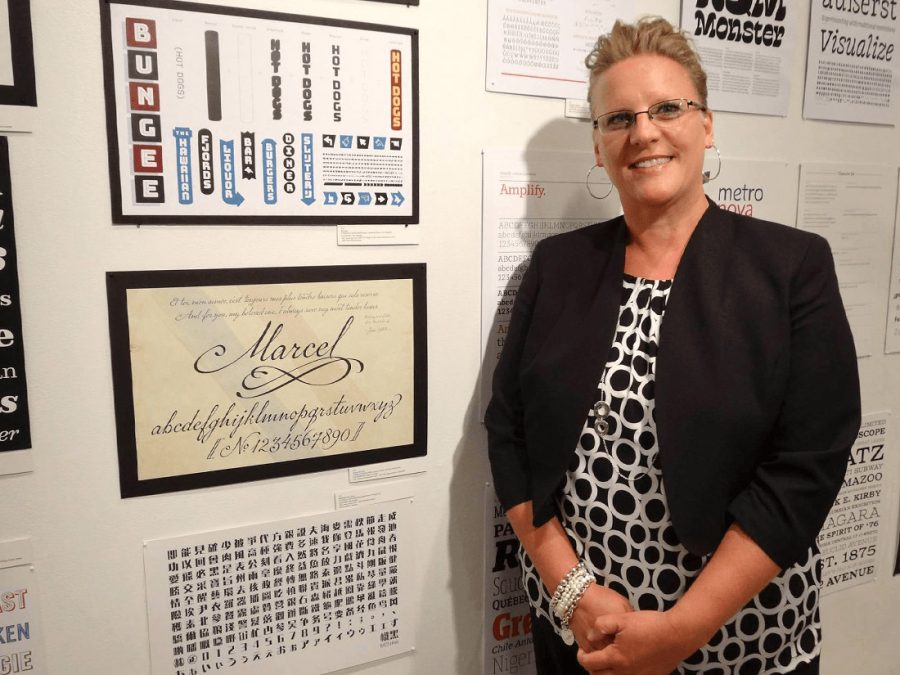

“I think it is important to students because it opens a lot more possibilities and opportunities for underprivileged students especially. That is where my focus and heart went when I heard the news,” Page Sutton said.

Sutton is a fourth-year student heavily involved in Winona State’s English department. Sutton majors in applied and professional writing, and last year she won the 2022 Winona Prize in poetry. Sutton is also a Pell Grant recipient.

“No one should have to spend their entire life worrying about money. I know what that feels like, and it is not a good feeling, it feels crappy, man,” Sutton expressed.

Growing up, Sutton’s family had trouble making ends meet. Sutton described how as early as preschool, she was on the free and reduced lunch programs and she received school grants for extracurriculars. Returning to school every year is still stressful for Sutton and her family, but she commented on how Biden’s announcement relieved some of her stress.

“Having $20,000 taken off my tuition, like that’s crazy! I am not going to have to stress out about it as much as my parents had to,” Sutton said.

Biden’s fulfillment of his campaign promises on student debt relief will impact many students at Winona State in a big way. According to Mari Livingston, the associate director of financial aid, the median federal debt after graduation at Winona State is $22,250. For most students at Winona State, Biden’s plan will half their federal debt, and nearly wipe it out completely for Pell Grant recipients.

Biden’s debt relief plan also takes steps to improve the student loan system for current and future borrowers. For one, the current and final loan repayment pause is getting extended through December, with payments starting up again in January 2023. Second, the percentage of borrowers’ monthly discretionary spending put towards paying undergraduate loans is going from 10 percent down to 5 percent. Thirdly, borrowers with balances of $12,000 or less will get their debt forgiven after 10 years of payments as opposed to the previous 20 years.

“It is a great idea, I think it is going to be very helpful for many, many people,” Livingston said. “Whether you are a current student right now, or you have graduated within the last 10 years, I think any kind of debt relief is welcome to a whole lot of people.”

Faye Lewis is a third-year student majoring in psychology with a minor in public relations. Lewis sees Biden’s student debt forgiveness plan as a good first step to combat the student debt crisis she sees manifesting in her own family.

“My parents have been married for 26 years, and they’ve both been out of college for 25. They are still paying off student loan debt and will continue paying off that debt until well after I have graduated from college myself. The fact of that is simply ridiculous,” Lewis said. “For half of their own lives thus far, they have been paying for college. No one, nowhere, should ever be doing that.”

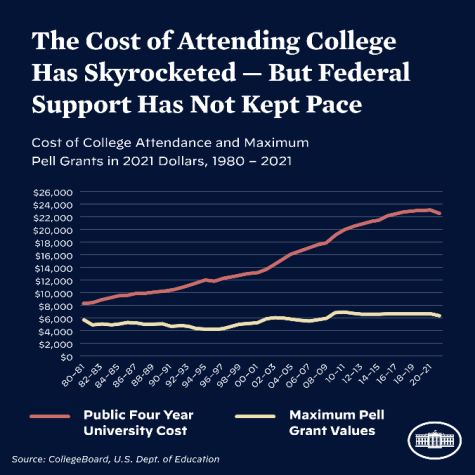

The Vice President of Finance and Administration, Scott Ellinghuysen, commented on why the cost of higher education has drastically increased in the last few decades, attributing it to decreased state funding to schools.

“The state should pay a portion, and then students are about 60 percent, that is funded by tuition, and 40 percent by the state. If you go way back 25 to 30 years, it was inverted. There is language that says the state should be providing two-thirds of the cost of the education and students one-third. We crossed over the 50-50 barrier in the early to mid 2000s,” Ellinghuysen said.

Lewis hopes that Biden’s plan will make higher education more appealing and improve enrollment rates.

“Plans that move in the direction of making college an easier financial burden could be a key move in raising enrollment rates and giving the opportunity for second education to those who didn’t think it was an option.”

The Biden administration’s student loan debt relief plan is not without its detractors. Some people are worried about rising tuition costs at colleges in response to the debt relief. Ellinghuysen wanted to clear any misunderstandings around this worry.

“In 25 years of working here and working with our students and working with our budget, we have never once said, ‘We can raise tuition higher because students can just take out loans to pay for it.’ That is a little bit of a narrative you read in the media now, that institutions will just keep raising tuition because knowing the loans will be forgiven at some point, that has never been discussed,” Ellinghuysen said.

Other people’s complaints of Biden’s plan stem from a sense of unfairness. Whether that is because they have already paid off their student debts, or they worry about increased taxes to pay for the student debt cancellation, there is a sense of almost resentment. In response to this, Sutton urges people to be more empathetic to others’ situations.

“You should not be worrying about other people’s financial situations if they don’t directly affect yours, and I don’t think this will directly affect yours,” Sutton said. “ It is not like we will see this monstrous difference in any of our taxes, it is going to be minute at best. I think people just don’t have a lot of empathy when it comes to finances.”

Kaileigh Weber is a fourth-year student double majoring in political science and public administration with a minor in public relations. Weber is also the senior seat on Winona State’s student senate. Despite being debt-free, Weber expressed her excitement for other students that Biden’s plan will help.

“By helping these students loosen up some of that money from their debt, it allows them to go and buy homes if that is something they are wanting to do. It allows them to participate in the economy more freely,” Weber said.

Weber is also the state chair of Students United. Students United is a Minnesota statewide student association representing and advocating for the 50,000+ students attending Minnesota State universities. Students United has advocated for students for the last 55 years and plans to continue representing Minnesota State students’ needs into the future.

“I would love to see debt cancellation across the board, just no more student debt, but also just lowering the cost of higher education for students,” Weber stated.

The Biden administration’s Aug. 24 student loan debt cancellation announcement has many people talking but many of the actual details of how the plan will work are still unknown. More specific information can be expected in the coming weeks. To keep up to date, regularly check the Office of Federal Student Aid’s website which is through the Department of Education.